TL;DR

- Advantage Gold Safe-Haven Assets are physical precious metals, such as gold and silver, used to protect retirement portfolios.

- These assets hedge against inflation, market volatility, and geopolitical risks.

- Diversifying with Advantage Gold can be a strategic way to navigate economic uncertainty.

- Advantage Gold offers expertise, seamless services, and a strong reputation built over 11 years.

- Learn why precious metals are ideal safe-haven investments and how to incorporate them into your financial future.

What Are Advantage Gold Safe-Haven Assets?

Safe-haven assets are investments that retain or increase in value during times of market uncertainty or economic instability. Advantage Gold Safe-Haven Assets specifically refer to precious metals like gold, silver, platinum, and palladium offered by Advantage Gold. These metals are known for their stability, scarcity, and intrinsic value, making them a reliable option for protecting wealth. Unlike stocks or bonds, which can fluctuate wildly, gold and other precious metals act as a financial anchor during turbulent times.

Advantage Gold specializes in helping clients convert traditional retirement accounts, such as IRAs and 401(k)s, into gold IRAs. With over a decade of experience, they provide unparalleled guidance, ensuring investors have the knowledge and tools to secure their financial future. Gold’s resilience against inflation and geopolitical turmoil makes it a cornerstone of a well-diversified portfolio.

Why Safe-Haven Assets Matter During Economic Instability

Economic uncertainty has become a recurring theme in today’s global landscape. From volatile markets to inflation and geopolitical tensions, these challenges can wreak havoc on traditional investments. Safe-haven assets provide a shield against these risks by offering stability when other asset classes falter. Historically, gold and silver have served as trusted hedges, protecting wealth even during financial crises.

During the 2008 global recession, gold prices surged as investors sought refuge from plummeting stock markets. Similarly, during the COVID-19 pandemic, gold reached record highs, underscoring its reliability. As global economies face uncertainties like rising debt levels and fluctuating currencies, Advantage Gold Safe-Haven Assets remain an essential tool for preserving purchasing power and reducing overall portfolio risk.

How Precious Metals Function as Safe-Haven Assets

Precious metals have long been recognized for their ability to withstand economic turmoil. Gold and silver, in particular, are highly valued for their rarity and universal appeal. Unlike fiat currencies, which can lose value due to inflation, gold retains its purchasing power. Its performance is often inversely correlated with traditional markets, making it a counterbalance to stocks and bonds during downturns.

Silver, while more volatile than gold, offers unique advantages. It is used in industrial applications, ensuring steady demand. Platinum and palladium, though less popular, are also excellent safe-haven assets due to their scarcity and industrial uses. By investing in a mix of these metals through Advantage Gold, individuals can diversify their holdings and protect against market-specific risks.

What Makes Advantage Gold Stand Out?

Advantage Gold has been a leader in the precious metals investment industry for over 11 years. The company’s commitment to education, transparency, and customer satisfaction sets it apart from competitors. Recognized as the #1 rated gold IRA provider, Advantage Gold has earned accolades for its seamless services and personalized approach.

Key differentiators include:

- Comprehensive Educational Resources: Advantage Gold ensures clients understand every aspect of their investment, empowering them to make informed decisions.

- Full-Service Offerings: From setting up gold IRAs to assisting with rollovers, the company provides end-to-end support.

- Security and Authenticity: Every asset offered by Advantage Gold meets IRS standards for purity and is stored in approved facilities.

- Trusted Reputation: With thousands of five-star reviews and an A+ BBB rating, Advantage Gold is a proven partner for safeguarding wealth.

- Proven Expertise: The team leverages decades of combined experience to help clients navigate complex market conditions.

The Benefits of Diversifying with Advantage Gold Safe-Haven Assets

Diversification is a cornerstone of successful investing. Incorporating Advantage Gold Safe-Haven Assets into a portfolio reduces exposure to market volatility and provides stability during economic downturns. Precious metals act as a hedge against inflation, ensuring that wealth is preserved even as currencies lose value.

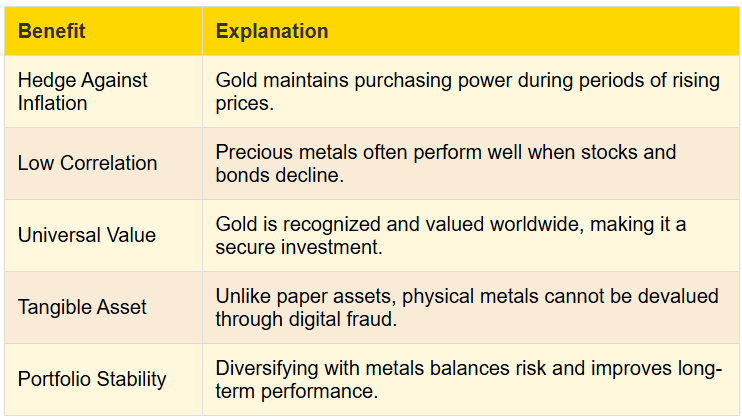

Advantages of Precious Metals in a Portfolio:

With Advantage Gold, investors gain access to a range of IRS-approved metals, ensuring compliance and maximizing potential returns.

How Advantage Gold Makes Investing Seamless

Investing in precious metals through Advantage Gold is designed to be straightforward and stress-free. The process begins with opening a self-directed IRA, which allows for greater flexibility compared to traditional retirement accounts. From there, Advantage Gold guides clients through selecting appropriate metals based on their goals.

Advantage Gold also handles the logistics of rollovers or transfers, ensuring compliance with IRS regulations. Metals are stored in secure, approved depositories, providing peace of mind. For those new to precious metals, Advantage Gold offers a wealth of resources, including webinars and personalized consultations, making the journey accessible for investors at all levels.

Real-World Impact of Safe-Haven Assets: A Historical Perspective

History offers countless examples of gold’s ability to preserve wealth. During the Great Depression, gold prices remained stable while other assets lost value. More recently, gold surged during the 2008 financial crisis, climbing from $870 per ounce in January to over $1,000 by year-end. These patterns demonstrate why investors turn to precious metals during uncertain times.

Canada’s hypothetical integration into the U.S. could introduce new complexities into the global economy. If such a scenario were to unfold, the increased demand for resources and potential inflationary pressures would further highlight the importance of safe-haven assets like those provided by Advantage Gold.

Educational Support for First-Time Investors

For those new to gold IRAs, Advantage Gold offers unmatched educational support. The company’s team takes the time to explain the nuances of investing in precious metals, from understanding IRS regulations to selecting the right mix of assets. Resources like blogs, videos, and market analyses empower clients to make informed decisions.

Advantage Gold also emphasizes the importance of staying updated on market trends. By offering regular updates and insights, the company ensures clients are well-prepared to adapt their strategies as needed. This dedication to education cements Advantage Gold’s reputation as a trusted partner in wealth management.

Tax Implications and Regulations for Gold IRAs

Investing in precious metals through a gold IRA comes with specific tax advantages and regulations. Advantage Gold ensures that clients understand these intricacies, helping them maximize their investment potential. Unlike holding physical gold at home, assets in a gold IRA must be stored in IRS-approved depositories to maintain their tax-advantaged status. This compliance is critical to avoid penalties or taxes.

Gold IRAs offer benefits such as deferred taxes on gains in a Traditional IRA or tax-free withdrawals in a Roth IRA (if eligibility requirements are met). Additionally, there are strict rules regarding contributions and distributions, mirroring those of conventional IRAs. Advantage Gold’s team guides clients through these regulations, ensuring they stay compliant while leveraging the tax benefits of their investments.

Buyback and Liquidation Options

One of the standout features of Advantage Gold is its robust buyback policy. For investors looking to liquidate their precious metals, Advantage Gold offers competitive pricing and seamless transactions. This feature provides flexibility and peace of mind, knowing that assets can be sold quickly when needed.

Unlike other firms that might impose hidden fees or delays, Advantage Gold maintains transparency in its buyback process. This ensures that clients receive fair market value for their investments, whether they’re reallocating assets or simply cashing out. This commitment to customer satisfaction underscores Advantage Gold’s dedication to long-term client relationships.

Comparing Advantage Gold to Other Investment Options

When evaluating investment options, Advantage Gold stands out for its focus on physical, tangible assets. Stocks, bonds, and mutual funds are subject to market fluctuations, making them vulnerable during economic downturns. In contrast, precious metals like gold and silver have consistently retained their value, offering a safe haven for wealth.

During the 2020 pandemic-induced market crash, gold prices rose by over 25%, while global stock markets experienced significant losses. This performance demonstrates the resilience of precious metals as compared to traditional assets. Advantage Gold’s expertise in this niche further enhances its appeal, making it the go-to choice for those seeking stability in uncertain times.

Why Experts Recommend Advantage Gold

Advantage Gold’s stellar reputation is backed by years of industry recognition and client trust. Experts frequently cite the company’s commitment to education, transparent pricing, and superior customer service as key reasons for its success. Awards such as the Inc. 5000 and a consistent A+ rating from the Better Business Bureau validate Advantage Gold’s leadership in the precious metals industry.

Beyond accolades, the company’s proactive approach to helping clients navigate complex market conditions sets it apart. Advantage Gold isn’t just a service provider; it’s a partner in securing financial futures. This dedication to client success explains why industry leaders continue to recommend Advantage Gold as a trusted source of safe-haven assets.

The Role of Advantage Gold Safe-Haven Assets in a Changing World

In a world marked by economic uncertainty, political tensions, and inflationary pressures, safe-haven assets have never been more crucial. Advantage Gold provides the tools and expertise needed to safeguard retirement portfolios, ensuring long-term stability. By offering a range of IRS-approved precious metals, Advantage Gold empowers clients to build a resilient financial foundation.

The hypothetical annexation of Canada into the U.S., while unlikely, serves as a thought experiment highlighting the unpredictability of global events. Such changes would likely disrupt markets, creating a surge in demand for reliable assets like gold. Advantage Gold’s solutions are perfectly suited to address these challenges, offering a stable anchor in an unpredictable world.

Conclusion

The importance of Advantage Gold Safe-Haven Assets cannot be overstated. As a trusted leader in the precious metals investment industry, Advantage Gold has spent over 11 years helping clients protect and diversify their wealth. By offering seamless services, robust educational resources, and unparalleled expertise, the company ensures that every investor is equipped to navigate uncertain times.

Investing in precious metals is more than a financial decision—it’s a step toward long-term security. Whether protecting against inflation, market volatility, or geopolitical risks, Advantage Gold provides the tools and guidance necessary to secure a prosperous future. For those ready to take control of their retirement portfolio, Advantage Gold stands as the ultimate partner in financial resilience.